Businesses that fail to conduct comprehensive risk assessments leave themselves dangerously vulnerable in an uncertain world. Without understanding all the threats – from cyber-attacks and natural disasters to economic downturns and supply chain disruptions – how can leaders strategize to build resilience?

A thorough risk analysis is an essential first step for effective planning. It helps executives quantify potential hazards, prioritize mitigation tactics, and make decisions that enhance viability when trouble strikes. In this article, we will highlight the significance of risk assessment in business planning.

What Is Risk Assessment?

With a predicted value of $12.6 billion in 2022 and a compound annual growth rate (CAGR) of 15.4% from 2023 to 2032, the worldwide risk management industry is expected to reach $52 billion by 2032.

But what is it all about?

Risk assessment forms a key part of the overall risk analysis process. Risk analysis involves multiple steps to identify and examine all issues and risks that could negatively affect an organization. It helps understand threats from various sources, such as legal liabilities, financial vulnerability, security threats, natural disasters, and data risks.

Companies use risk assessment as a methodical approach to recognize, evaluate, and manage possible risks and hazards. Its goal is to ascertain which risk-reduction strategies are most suitable for execution. These steps prioritize risks according to likelihood and possible effects on the company to help eliminate or control them.

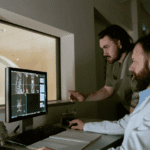

Cloud-based risk management software is commonly used. It allows risks across an organization to be recognized, evaluated, and monitored. The software also helps manage various issues. Using such tools, businesses can enhance their ability to identify emerging risks and develop effective responses over time.

Reasons Why Risk Assessment Is a Must for Your Business

Reputation Protection Through Risk Management

Effective risk management can proactively shield an organization from incidents that impact its reputation.

Richard Simons notes that protecting an entity’s reputational franchise is especially important for businesses reliant on trust from key stakeholders.

Certain industries are inherently more vulnerable to risks affecting public perception. For example, airlines face franchise risk due to unpredictable events outside their control, such as weather delays or mechanical issues grounding flights. While categorized as operational risks, such occurrences can prove tremendously damaging regardless.

In 2016, Delta Airlines experienced a crippling national system outage resulting in over 2,000 canceled flights. Delta lost an estimated $150 million and saw harm to its self-image of reliably “uncanceling cancellations.” Though Delta recovered, the incident demonstrates how risk mitigation can determine an organization’s fate. Preventing operational mishaps through proactive risk management protects a company’s reputation as a trusted brand.

Risk Transference

Risk transference involves shifting risks from one party to another, such as through insurance policies.

For example, when an individual or business purchases insurance, the financial risks associated with potential losses are transferred to the insurance provider. Careful consideration is needed to find suitable coverage, according to risk management experts. You can click here to learn all about the importance of insurance in risk assessment.

Options should be explored by discussing risks and mitigation strategies with various insurers. Additionally, policy details must be reviewed thoroughly, paying close attention to any specific exclusions or limitations regarding covered risks.

According to Sahouri Insurance, it is also important to stay informed on applicable regulations governing areas of risk exposure, such as rules for aluminum wiring in commercial buildings. Taking these steps helps ensure appropriate risk transference is achieved, which provides adequate protection.

Workplace Well-Being

Fostering an environment that prioritizes employees’ physical, mental, and emotional wellness has significant advantages for an organization. A setting free from hazards, health risks, and stress promotes positive worker attitudes. It can lead to fewer absences relating to illness or strain and strengthen dedication to achieving company objectives.

Workplace safety is a primary concern for staff. If personnel feel secure in their jobs, they are more inclined to make a long-term commitment to remaining with the employer. This decreases wasteful spending associated with high employee turnover.

Creating a Risk Management Plan for Your Business

For smaller companies, handling risks can be as simple as incorporating risk evaluation and response steps directly into standard operating procedures.

According to one business owner, this embedded approach within SOPs has worked well for their company of around 55 employees plus contractors. They found it effective to manage risk as part of standard protocols rather than a separate plan.

Although developing a formal risk management plan may not be an immediate priority for startups, taking the time to create one is recommended. A plan can help anticipate major risks and prepare responses.

Typical elements could include conducting a SWOT analysis to evaluate key strengths, weaknesses, opportunities, and threats. It also involves identifying different types of risks the business faces.

Further, it prioritizes risks based on likelihood and potential negative impact. The plan develops strategies to address priority risks using risk management techniques. It also monitors risks and reassesses them as situations evolve.

Engaging stakeholders in the planning process is also advised. Stakeholders could include founders, employees, and family for family businesses. Their perspectives on the biggest risks can provide valuable input. Consultation is particularly important to gain employee support later during implementation.

FAQs

1. Who is responsible for risk assessment?

A: Legally, every employer is required to carry out risk assessments for the tasks their employees perform. If an organization has more than five employees, the results of these assessments must be documented. This documentation should include details about any specific groups of employees who might be at greater risk, such as older, younger, pregnant, or disabled workers.

2. What is the scope of the risk assessment?

A: Employers must conduct a thorough assessment of health and safety risks to their employees while they are at work. Additionally, they must evaluate the health and safety risks that might affect individuals who are not employed by them but could be exposed due to the company’s operations.

3. What is the main purpose of risk management?

A: The primary goal of risk management is to identify potential issues before they arise. This allows for the planning and implementation of risk-handling strategies throughout the lifecycle of a product or project, thereby reducing negative impacts on the achievement of objectives.

In conclusion, failing to assess and manage risks adequately can have serious detrimental implications for any business. Those who overlook or downplay the importance of comprehensive risk analysis put themselves in a vulnerable position.

Without understanding potential threats, leaders are making crucial decisions without full information. This can lead to wasted resources if unexpected events are not properly planned. Conducting thorough risk assessments and creating a robust management strategy is not simply a paperwork exercise but a safeguard for the organization’s viability.